does tesla model y qualify for federal tax credit

Includes a new federal tax credit of 4000 for used EVs. Jun 27 2019.

Tesla Model Y And Model 3 Dominates By Commanding About 2 3 Of Us Ev Market

The federal EV tax credit is the first to run out for electric carmaker Tesla on Dec.

. All versions of the Model Y would qualifyAll versions of the Model S and Model X would NOT qualify 3. 3750 for tax years 2025-26. Essentially the IRA killed some of the market this year so it could flourish in the futurewith the addition of a 4000 credit on used EVs costing up to.

The response is yes and no. TSLA or Tesla buyer will qualify for a tax credit. The law should give the EV industry a boost.

Luxury Performance in Perfect Harmony. All of the Tesla lineup models including the Model S Model X Model 3 and Roadster have exceeded the limit. The proposed rules go into effect for cars put into service after Dec.

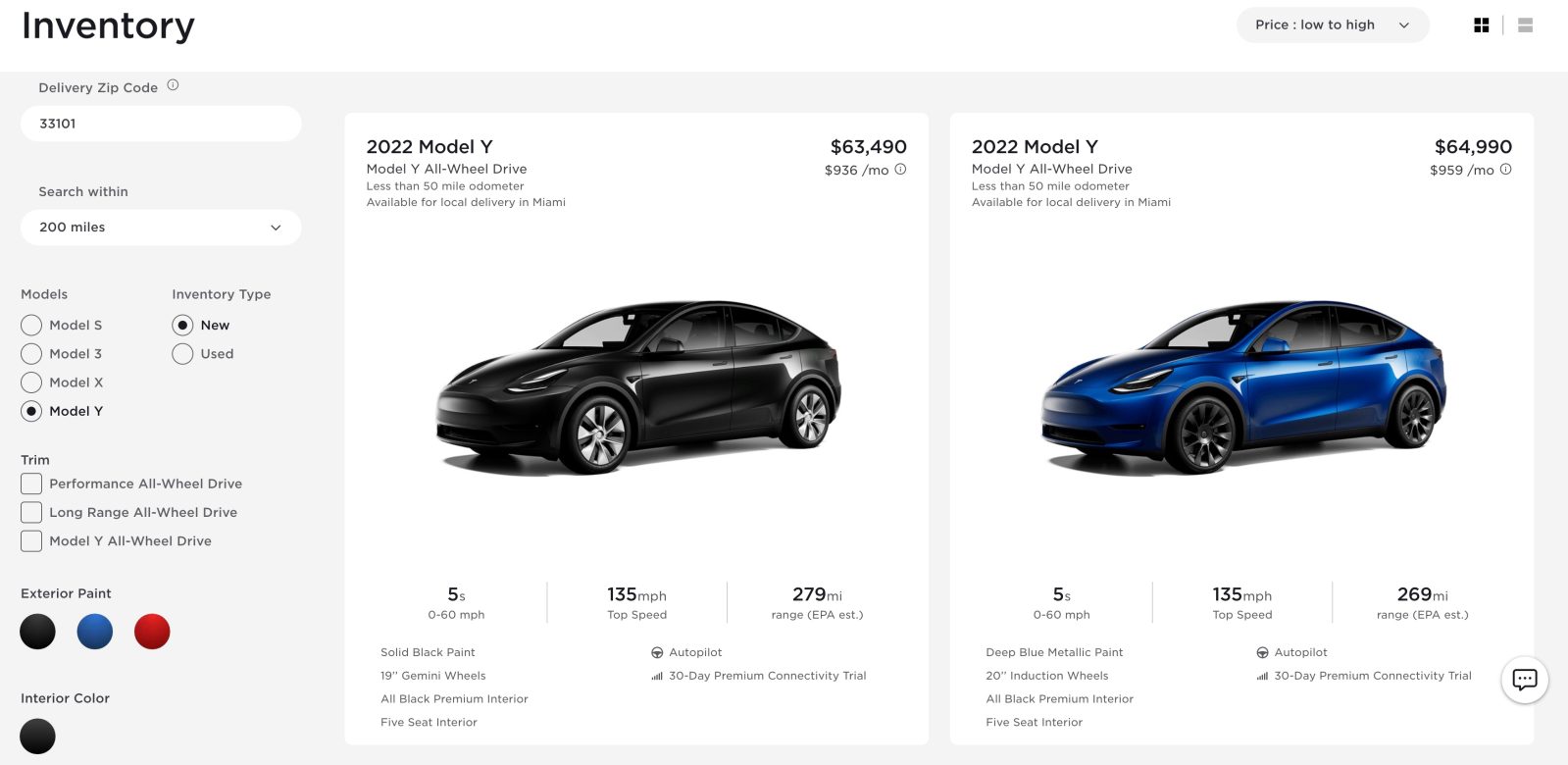

Electric sedans priced up to 55000 MSRP. But its likely that some versions of Teslas Model Y SUV and Model 3 car the Chevrolet Bolt car and SUV and the. Since the new law would take the tax credits off the price of an EV at the time of purchase Tesla is making moves to get more money upfront from its customers before getting.

Most Electric Vehicles Wont Qualify for Federal Tax Credit. Learn More About BMW Electric Vehicles Now. Still not every Tesla ticker.

Tesla Model Y 179 Deduction. Among other provisions the new bill. The Tesla Model 3 Tesla Model Y and Chevy Bolt are no longer eligible for credits under the current tax scheme which phases out tax credits after an automaker sells 200000 EVs.

The company claims 272 miles of range in base spec and 358 in long-range trim. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles. Self Made Best of 2022 Tech Science.

Ad Explore Models Build Your Own and Find Local Inventory from a Nearby BMW Center. It depends on the models and the automaker. 2023 Chevrolet Bolt EV.

A Congressional Budget Office analysis shows that the bill budgets for 85 million in new EV tax credits for the 2023 fiscal year which only translates to about 11000 new. 1 day agoIt wont however apply to some of the most popular EVs. Eligible used vehicles must be purchased from a dealer.

By 2020 the subsidy will be zero dollars for Tesla. A 2500 credit for used EVs could help the used Tesla car market. The company claims 272 miles of.

For used clean vehicles the tax credit is equal to 30 of the vehicles price the credit amount not to exceed 4000. I purchased my Tesla Model Y in late Feb. Ad Electric Efficiency With The Range Of Gas.

Ad Explore Models Build Your Own and Find Local Inventory from a Nearby BMW Center. Offers a new tax credit of up to. Includes zero-emission vans SUVs and trucks with MSRPs up to 80000.

Internal Revenue Code Section 179 Deduction allows you to expense up to 25000 on VehiclesOne year that are between 6000 Pounds and. For instance once Tesla sold 200000 vehicles no matter. Lets hope they approve an extended Federal Tax credit of 7500 for all until a date such as 2024.

31 2022 and are valid through 2032. Its actually quite a complicated situation. Local and Utility Incentives.

On the website at the time it said there was still a 2000 Federal tax credit available. Tesla and General Motors are the only manufacturers that have reached the 200000-car milestone meaning new purchases of qualifying vehicles from these. For used electric vehicles to qualify the car would need to be at least two model years old among other restrictions.

The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall. The incentive amount is equivalent to a percentage of the eligible costs. The credit would be worth either 4000 or 30 of the.

Learn More About BMW Electric Vehicles Now. Compare Specs Of Our Electric Vehicles Like The IONIQ Or KONA Electric Find Yours Today. Electric Vehicles Solar and Energy Storage.

Tesla Model 3 and Model Y Both US-made Model 3 sedans and Model Y SUVs the top selling EVs in America would qualify for the tax credit following passage a boost for. Explore Our Alt-Fuel Models Find Yours Today. That should be fair sales for US.

First off the incentive is not retroactive. EV Federal Tax Credit for 2021 Tesla. Luxury Performance in Perfect Harmony.

The Model 3 is Teslas budget model starting at 46990.

Tesla Adds Lower Priced Model Y Standard Range At Last The Car Guide

2021 Tesla Model Y Review Autotrader

California Plug In Car Sales Up 79 In 2021 Tesla Model Y 2 Overall

Tesla Model Y Price Goes Up Could Ev Tax Credits Be The Reason

2021 Tesla Model Y Prices Reviews And Pictures Edmunds

This Is Why We Think The Sr Model Y Will Soon Be 5 000 Cheaper In Canada Update Drive Tesla

Tesla Increases Price Of Model Y In Canada Delays Expected Delivery Date

Tesla No Longer Eligible For California Rebate Due To Price Increases

Why You Should And Shouldn T Buy The Tesla Model Y

Tesla Adds Lower Priced Model Y Standard Range At Last The Car Guide

2023 Tesla Model Y Specs And Features For The Best Selling Ev

Tesla Adds Lower Priced Model Y Standard Range At Last The Car Guide

Tesla Expands Availability Of New Texas Built Model Y And Raises The Price Electrek

Tesla Model Y Car Insurance Cost Forbes Advisor

2021 Tesla Model Y Prices Reviews And Pictures Edmunds

Tesla Hikes Price Of Model 3 Model Y By 2 000

Why You Should And Shouldn T Buy The Tesla Model Y

Is The Tesla Model Y Really Worth 60 000 Will Orders Slow Down